The High Court decisions are binding on Subordinate Courts within their Jurisdiction and these are not binding on other High Courts --- Supreme Court of Pakistan

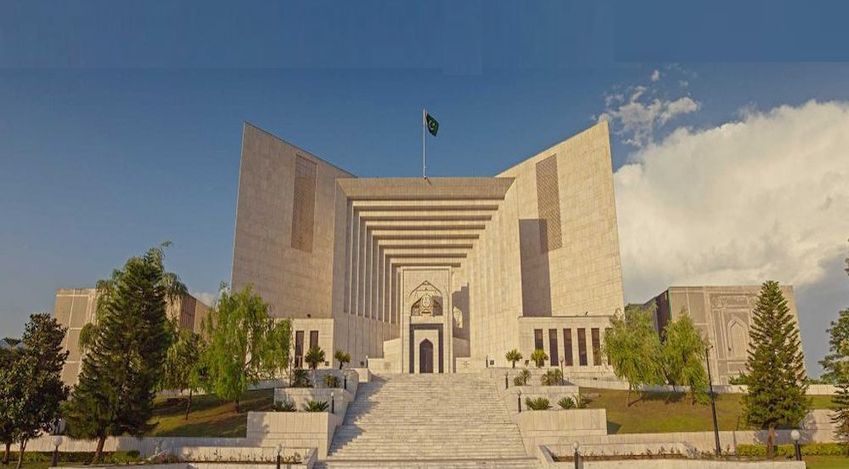

Islamabad 01-08-2024: In a landmark decision, the Supreme Court of Pakistan upheld the validity of section 3A of the Federal Excise Act 2005, affirming the Federal Government's authority to levy and collect special excise duty on goods produced or manufactured in Pakistan and goods imported into the country. The ruling came in a series of consolidated appeals involving multiple sugar mills and other corporations challenging the imposition of the excise duty.

The appeals arose from conflicting judgments of the Lahore High Court and the Sindh High Court regarding the legality of section 3A and the associated notification issued by the Federal Government. While the Lahore High Court had dismissed challenges to the notification without questioning the vires of section 3A, the Sindh High Court declared the provision void ab initio, citing impermissible delegation of legislative powers.

Mr. Justice Athar Minallah, delivering the judgment, emphasized the trichotomy of powers embedded in the Constitution, which delineates the distinct roles of the legislature, executive, and judiciary. The Court underscored the presumption of constitutionality afforded to legislative acts, placing the burden of proof on those challenging the validity of a law.

The Court found that section 3A did not constitute an impermissible or excessive delegation of legislative authority. The legislature had provided clear guidelines and standards for the Federal Government to follow, delegating only ancillary and incidental functions rather than essential legislative tasks. The Court reaffirmed that such delegation is common in taxation statutes and necessary for implementing legislative objectives.

The Supreme Court highlighted the binding nature of its previous decisions, noting that the judgment of the Lahore High Court had attained finality after being upheld by the Supreme Court. Consequently, the Sindh High Court's decision to strike down section 3A and the notification was not sustainable. The Court clarified that while High Court decisions are binding on Subordinate Courts within their jurisdiction, they are not binding on other High Courts.

Addressing the issue of refunds, the Court held that the High Court of Sindh was not competent to order refunds in violation of the Federal Excise Act 2005. Refund claims must adhere to the statutory procedures, ensuring that the claimant is not unjustly enriched.

Chief Justice Qazi Faez Isa added a separate note, expressing agreement with the judgment except for two sentences concerning the binding effect of High Court decisions on other High Courts. The Court emphasized that under Articles 201 and 189 of the Constitution, High Court decisions bind only Subordinate Courts, while Supreme Court decisions bind all courts.

The judgment also addressed the importance of timely delivery of judicial decisions. Citing the principle that "justice delayed is justice denied," the Court stressed the need for judgments to be delivered within a reasonable timeframe, aligning with constitutional mandates for expeditious justice.

The Supreme Court's decision reinforces the constitutional framework governing legislative delegation and judicial review, providing clarity on the limits of executive power in taxation matters. The ruling has significant implications for the administration of federal excise duties and the broader principles of constitutional law in Pakistan.

Powered by Froala Editor