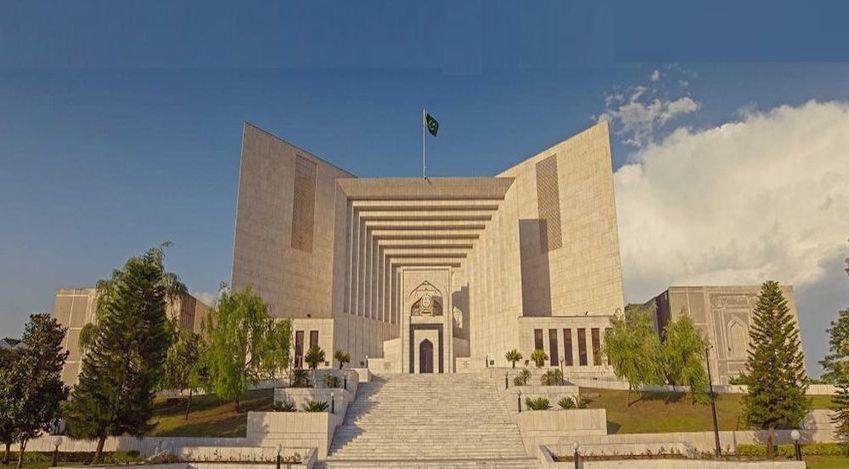

Supreme Court of Pakistan Upholds Petitions Challenging Tax and Import Regulations in Merged Tribal Areas --- SCP

Islamabad 23-05-2024: In a recent ruling, the Supreme Court of Pakistan addressed the petitions [Civil Petitions No. 1896, 1897 & 1900 of 2022] brought by “M/s Taj Wood Board Mills (Pvt) Ltd, M/s Al-Mashood Oil & Ghee Industries (Pvt) Ltd, and M/s Bara Ghee Mills (Pvt) Ltd”. The petitioners, companies operating in the former Federally Administered Tribal Areas (FATA) and Provincially Administered Tribal Areas (PATA), challenged the Peshawar High Court's judgment dated 09-02-2022.

The petitioners' grievance stemmed from the Constitutional changes following the merger of FATA and PATA into Khyber Pakhtunkhwa in 2018, which extended fiscal and tax laws to these areas. Previously, these areas enjoyed exemptions from such laws. The Federal Government issued several orders and circulars to manage this transition, including SROs and Customs General Orders (CGOs) to regulate import procedures and tax exemptions.

The Peshawar High Court had partially upheld and partially struck down certain terms of the CGOs and circulars. Affirmed the Federal Board of Revenue's authority to issue Circular No. 1 of 2021, except for condition (v) regarding annual audits. Declared condition (v) of Circular No. 1 of 2021 illegal and struck it down. Stated that Circular No. 9 of 2021, intended for a one-time release of goods, was no longer applicable.

Upon appeal, the Supreme Court upheld the Peshawar High Court's findings, specifically agreeing that Condition (v) of Circular No. 1 of 2021 introduced a parallel audit system, which was unnecessary given existing provisions in the Income Tax Ordinance, 2001, and the Sales Tax Act, 1990. Circular No. 9 of 2021 was a one-time measure and not applicable to regular imports by the petitioners.

The core issue in the Supreme Court was whether preferential treatment given to bulk-importing edible oil manufacturers under CGO No. 8 of 2021 was justified. The petitioners argued this was discriminatory. The Supreme Court referenced a recent judgment (M/s AK Tariq Foundry case) where a similar classification was struck down as unconstitutional.

The Supreme Court ruled in favor of the petitioners, converting their petitions into appeals and declaring that the discriminatory provisions in CGO No. 8 of 2021 violated the equality clause under Article 25 of the Constitution. The preferential treatment for bulk-importing edible oil manufacturers, to the exclusion of other industries, was deemed unjustifiable.

This ruling reinforces the constitutional principle of non-discrimination and mandates equal treatment for all businesses in the merged districts regarding tax and import exemptions.