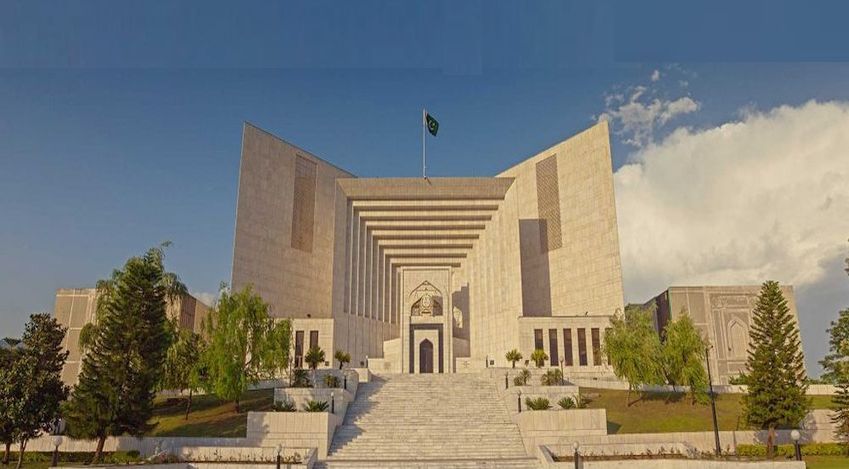

Supreme Court of Pakistan Declares Timeframe for Tax Appeals as Directory in Nature to Safeguards Taxpayer Rights

Islamabad 16-11-2024: In a landmark judgment, the Supreme Court of Pakistan has ruled that the statutory timeframes outlined in Section 45B(2) of the Sales Tax Act, 1990 for appellate adjudication are directory, not mandatory. The ruling addresses significant implications for the rights of taxpayers and the functioning of appellate tax authorities.

The three-member bench, led by Mr. Justice Syed Mansoor Ali Shah and joined by Ms. Justice Ayesha A. Malik (dissenting), resolved conflicting interpretations regarding the timeframe within which the Commissioner (Appeals) must decide tax cases. The Court overturned its earlier decision, partially allowing the review petition filed by the Commissioner Inland Revenue, Zone-III, RTO, Rawalpindi against M/s Sarwaq Traders.

The majority held that the first and second provisos of Section 45B(2), which set a 120-day timeframe (extendable by 60 days) for the disposal of appeals, are directory in nature. Mr. Justice Syed Mansoor Ali Shah emphasized that delays should not invalidate the taxpayer’s right to appeal or nullify decisions based on procedural technicalities. Instead, appeals must be adjudicated on their merits, ensuring fairness and justice.

The decision protects taxpayers from being penalized for procedural delays beyond their control. The Court underscored that a taxpayer’s constitutional rights to due process and fair trial, as enshrined in Articles 4, 9, and 10A of the Constitution, must not be compromised by rigid adherence to procedural timeframes.

The Court distinguished between original adjudication, initiated by the tax department, and appellate adjudication, initiated by taxpayers. It held that while strict timelines might apply to original adjudication, appellate proceedings must prioritize the substantive rights of taxpayers over procedural compliance.

The judgment drew upon precedents, including:

- A.J. Traders (2022): Declared similar timeframes in Section 194-B of the Customs Act, 1969, as directory.

- Mujahid Soap (2019): Affirmed mandatory timeframes for original adjudication under Section 179 of the Customs Act, 1969.

- Super Asia (2017): Held Section 36(3) of the Sales Tax Act, 1990, as mandatory for original adjudication.

Ms. Justice Ayesha A. Malik dissented, arguing that adjournments sought by taxpayers during appellate proceedings should be excluded from the statutory timeframe under the third proviso to Section 45B(2). She contended that the Tribunal and High Court had failed to account for these adjournments, potentially altering the case’s outcome.

The Court remanded the case to the Appellate Tribunal Inland Revenue to decide the taxpayer’s appeal expeditiously on its merits, ensuring justice for all parties involved. The decision affirms the judiciary’s role in balancing procedural efficiency with the protection of constitutional rights.

Powered by Froala Editor