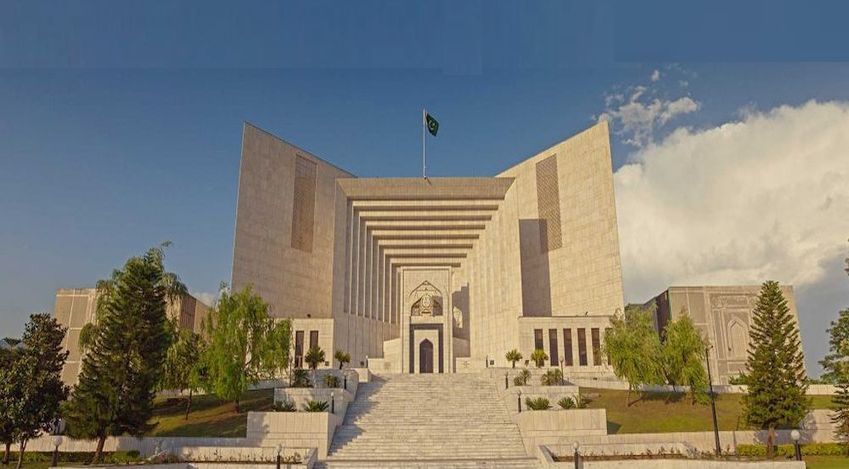

Retrospective Exemptions via Subordinate Legislation cannot nullify Past Transactions or Vested Rights without Explicit Primary Legislative Authorization --- Supreme Court of Pakistan

Islamabad 16-11-2024: In a landmark ruling, the Supreme Court of Pakistan dismissed multiple appeals filed by tax authorities, reaffirming the rights of taxpayers to claim input tax adjustments under the Sales Tax Act, 1990, even in cases where goods are destroyed or exemptions are applied retrospectively. The judgment, delivered by a three-member bench headed by Mr. Justice Yahya Afridi, provides critical guidance on input tax adjustments, tax refunds, and the scope of retrospective legislation.

The appeals, including the lead case of Commissioner Inland Revenue Vs. Mayfair Spinning Mills Ltd., revolved around whether taxpayers could adjust input tax for goods damaged before use or claim refunds under the relevant provisions of the Sales Tax Act. Additional cases involved pharmaceutical manufacturers who challenged the retrospective application of sales tax exemptions introduced via subordinate legislation.

Key Legal Questions

- Can input tax adjustments be made for goods destroyed before use, such as by fire?

- Do retrospective exemptions nullify past tax adjustments already claimed?

- To what extent can subordinate legislation override vested rights?

The Court upheld the majority decision of the Lahore High Court in the Mayfair Spinning Mills case, affirming that input tax adjustments under Section 7 of the Sales Tax Act are tied to the tax period during which the tax was paid, not the physical use of the goods. Mr. Justice Yahya Afridi clarified that goods intended for taxable supplies, even if damaged, qualify for adjustments provided other statutory conditions are met.

Commissioner Inland Revenue Vs. Attock Cement Pakistan Ltd. (2023 SCMR 279), Sheikoo Sugar Mills Vs. Govt. of Pakistan (2001 SCMR 1376).

In appeals involving pharmaceutical companies, the Court ruled against the tax authorities’ attempt to recover input tax adjustments following the retrospective withdrawal of sales tax through SROs issued in 2002. The Court emphasized that subordinate legislation cannot nullify vested rights or past and closed transactions without explicit legislative authorization.

The judgment solidifies the principle that taxpayers are entitled to claim input tax adjustments and refunds for goods purchased during a valid tax period, regardless of subsequent destruction or retrospective exemptions. It also reinforces protections against the arbitrary application of subordinate legislation.

This decision serves as a pivotal precedent for resolving tax disputes, ensuring clarity on the scope of taxpayer rights under the Sales Tax Act. By rejecting arbitrary interpretations and affirming the supremacy of legislative intent, the Court has reinforced the balance between tax collection and taxpayer protections.

Powered by Froala Editor