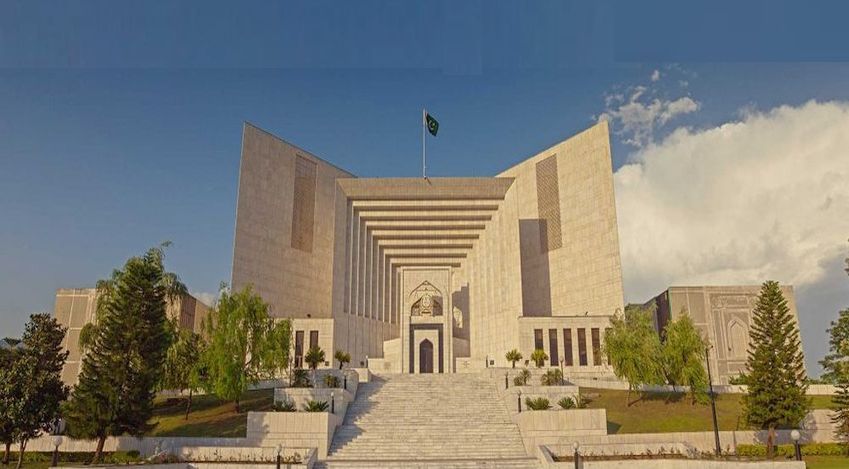

Minority Shareholders and Unsecured Creditors retain the right to pursue Independent Legal Remedies but cannot challenge a scheme based solely on Dissatisfaction with its terms --- Supreme Court of Pakistan Upholds Scheme of Arrangement

Islamabad 01-01-2025: The Supreme Court of Pakistan has dismissed a Civil Petition for Leave to Appeal [C.P.L.A. No. 1721-K of 2021] filed by State Life Insurance Corporation of Pakistan, challenging the approval of a “Scheme of Arrangement” for Nina Industries Limited by the Sindh High Court. The apex Court affirmed the legality of the scheme, which prioritized the claims of secured creditors, and upheld the decision of the lower Court.

The petition arose from an order dated October 25, 2021, issued by a Single Judge of the Sindh High Court under Sections 284, 285, and 287 of the Companies Ordinance, 1984, approving a scheme for restructuring the financial obligations of Nina Industries Limited. The scheme, sanctioned after securing approval from 95.09% of secured creditors and 100% of shareholders, aimed to address the company’s financial distress and settle its liabilities.

State Life, a minority shareholder with an 8.26% stake, opposed the scheme on the grounds that:

- It exclusively catered to secured creditors, ignoring the interests of minority shareholders.

- The valuation of assets in the scheme was allegedly mala fide.

- The scheme would effectively dissolve the company, leaving no tangible assets.

Despite these objections, the Sindh High Court sanctioned the scheme, prompting State Life to appeal to the Supreme Court of Pakistan.

A two-member bench, comprising Mr. Justice Irfan Saadat Khan and Mr. Justice Aqeel Ahmed Abbasi, upheld the Sindh High Court’s decision. Key observations included:

- The scheme complied with statutory requirements under Sections 284 and 285 of the Companies Ordinance, 1984, and procedural rules such as Rule 55 of the Companies Court Rules, 1997.

- Secured creditors, as a priority class, have preferential rights over the company’s assets in corporate restructuring scenarios.

- Minority shareholders and unsecured creditors retain the right to pursue independent legal remedies but cannot challenge a scheme based solely on dissatisfaction with its terms.

The Court also noted that the objections raised by State Life were not sustainable under corporate law principles, as no procedural irregularities or violations of the Companies Ordinance were demonstrated.

The Supreme Court of Pakistan dismissal of the petition reaffirms the legal framework for corporate restructuring in Pakistan, emphasizing the primacy of secured creditors’ rights and the limited role of minority shareholders in such matters. The judgment also underscores the importance of statutory compliance and majority approval in the sanctioning of schemes of arrangement.

Powered by Froala Editor