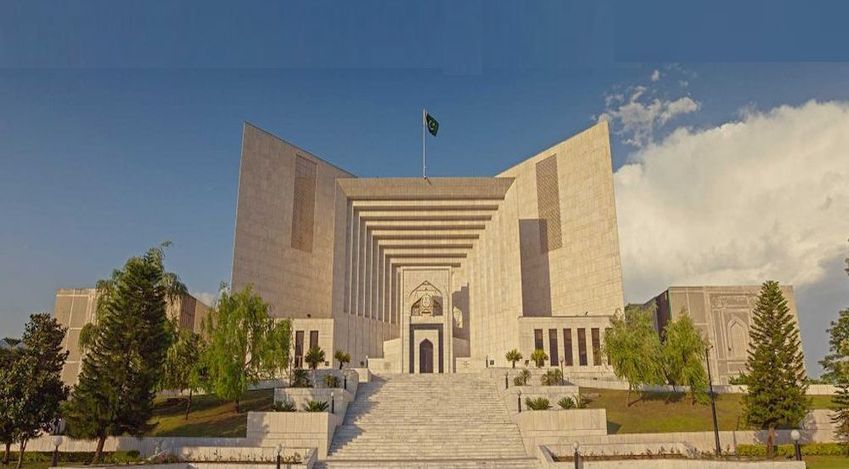

Industrial Entities using Private Generators for Self-Consumption are not liable for Electricity Duty under Section 13 of the Punjab Finance Act, 1964 --- Supreme Court of Pakistan

Islamabad 09-10-2024: The Supreme Court of Pakistan has dismissed a series of appeals filed by the Government of Punjab, upholding the Lahore High Court’s decision that exempted various industrial and commercial entities from paying electricity duty on self-generated power. The case, which involved multiple industrial entities, including textile and sugar mills, revolved around the interpretation of Section 13 of the Punjab Finance Act, 1964, as amended by the Punjab Finance Ordinance, 2001.

The judgment, authored by Mr. Justice Munib Akhtar and supported by Mr. Justice Syed Hasan Azhar Rizvi and Mr. Justice Shahid Waheed, clarifies that entities generating electricity for their own use through private generators are not liable to pay electricity duty under the existing legal framework. The Court reasoned that self-consumption of electricity does not meet the statutory requirement of "supply" necessary to trigger the tax liability under Section 13 of the Act.

The dispute arose when the Punjab Government, through notifications issued in 2001, sought to impose electricity duty on industrial and commercial entities using private generators with a capacity exceeding 500 KW. The 2001 notification rescinded an earlier exemption granted in 1985, which had exempted private generators from such a duty. This move by the provincial government was challenged by the affected parties in the Lahore High Court, which ruled in favor of the companies, leading the government to file the appeals in the Supreme Court.

The Supreme Court dismissed the appeals, ruling that while the definition of “licensee” under the 2001 Ordinance was expanded to include entities generating more than 500 KW of power for self-use, this did not automatically make them liable for electricity duty. The Court held that the duty under Section 13 is applicable only when electricity is supplied to a third party. Thus, self-consumption by entities such as the respondents in the case did not constitute a taxable event.

The judgment clarified that any imposition of a fiscal levy like electricity duty must be interpreted strictly, as per established principles of interpretation of fiscal statutes. It noted that any ambiguity or uncertainty in the interpretation of tax provisions should be resolved in favor of the taxpayer. The decision referenced the principles outlined in the earlier case of “H.M. Extraction Ghee & Oil Industries (Pvt) Ltd. v Commissioner of Inland Revenue”, [2019 SCMR 1081], and reiterated that, in case of multiple reasonable interpretations, the one favorable to the taxpayer should prevail.

The Supreme Court’s ruling effectively prevents the Government of Punjab from imposing electricity duty on private generators used for self-consumption. This decision is likely to have significant implications for industries relying on self-generated power, particularly in light of the ongoing energy challenges in the province.

In its concluding remarks, the Supreme Court stated that while it dismissed the appeals on different grounds than those adopted by the Lahore High Court, it affirmed the overall outcome. The judgment clarified that self-consumption of electricity falls outside the scope of Section 13’s tax liability, thereby providing clarity on the tax treatment of self-generated power.

This landmark judgment reaffirms the principle that tax statutes must be construed strictly and any doubt should be resolved in favor of the taxpayer, setting a precedent for future disputes involving similar fiscal levies.

Powered by Froala Editor