A Bank Statement alone does not Amount to Definite Information unless it provides a Clear and Undeniable Indication of Taxable Income --- Supreme Court of Pakistan

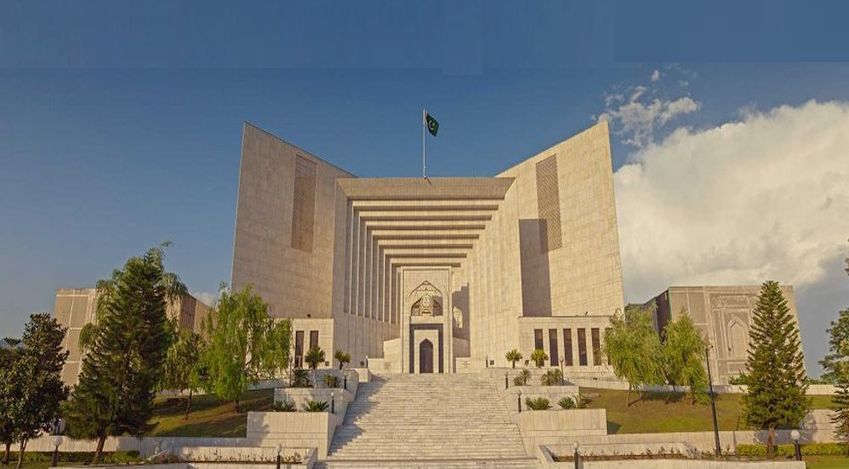

Islamabad 06-03-2025: In a landmark ruling, the Supreme Court of Pakistan has reaffirmed that bank statements alone do not constitute “definite information” sufficient to justify tax reassessment under the Income Tax Ordinance, 2001. The Court dismissed an appeal by the Federal Board of Revenue (FBR) in the case of Commissioner Inland Revenue Vs. M/s Khudadad Heights, Islamabad, upholding the Islamabad High Court (IHC) decision.

The dispute arose when the FBR’s Commissioner Inland Revenue (Special Zone for Builders & Developers, Islamabad) issued a notice under Section 122 of the Income Tax Ordinance, 2001, seeking to amend the tax assessment of M/s Khudadad Heights for the tax year 2006. The sole basis for the reassessment was a bank statement, prompting legal challenges by the taxpayer.

The case went through multiple stages of appeals:

- The Commissioner (Appeals-I), Islamabad provided partial relief.

- The Appellate Tribunal Inland Revenue (Islamabad Bench-I) ruled entirely in favor of the taxpayer.

- The Islamabad High Court (IHC) upheld the Tribunal’s decision, concluding that bank statements do not automatically indicate taxable income and thus do not qualify as “definite information” under the law.

FBR then filed an appeal before the Supreme Court of Pakistan, arguing that the High Court misapplied legal precedents from the repealed Income Tax Ordinance, 1979, and that the 2001 Ordinance provides a distinct framework for reassessment.

A two-member bench comprising Mr. Chief Justice Yahya Afridi and Mr. Justice Muhammad Shafi Siddiqui dismissed the FBR’s petition, emphasizing key legal principles:

- A bank statement alone does not amount to definite information unless it provides a clear and undeniable indication of taxable income.

- The Court referenced the precedents set in “Khan CNG Filling Station Case” (2017 SCMR 1414) and “Bashir Ahmed Case” (2021 SCMR 1290), where definite information was defined as “information that does not require further inquiry or scrutiny to establish tax liability.”

- Unlike gas consumption data in the Khan CNG case, which was quantifiable and verifiable, bank transactions require further analysis to determine their taxability.

- The Court found that FBR failed to conduct an independent audit or issue a notice under Section 111 of the Income Tax Ordinance, 2001, which deals with unexplained income/assets.

- The Appellate Tribunal Inland Revenue is the last fact-finding authority, and its conclusions cannot be disturbed unless there is a clear legal misinterpretation.

- The Supreme Court of Pakistan reiterated that higher Courts should not interfere in factual determinations made by the Tribunal unless gross errors in law are evident.

- The Supreme Court of Pakistan held that tax reassessment cannot be conducted arbitrarily or without statutory compliance.

The absence of an audit-based review or a Section 111 notice further weakened FBR’s case.

Powered by Froala Editor